Although the federal minimum wage rate — the minimum employers are allowed to pay employees per hour — is not set in stone, it has not increased since 2009. The Fair Labor Standards Act sets the minimum wage and the U.S. Department of Labor enforces it. So, what is the minimum wage? Currently, $7.25 per hour (though it may be higher in your city or state).

At 40 hours per week, minus about 30% in taxes, that’s about $200 per week. According to Realtor.com research, rent in the U.S. reached an all-time median high in April 2022, topping out at over $1,800 per month. This is, of course, a broad swathe, but simple math shows that working full-time at minimum wage is not tenable. Especially considering significant inflation to essential commodities in just the past few months.

In response, the Massachusetts Institute of Technology in Cambridge recently took a deep dive on the Living Wage Calculator first created in 2004 by Dr. Amy K. Glasmeier. Each year since, Glasmeier has worked with colleagues to tweak the formula to increase its accuracy. The calculator’s purpose is to reexamine the standard of living conditions beyond the poverty threshold that federal policymakers often use to determine social aid. MIT takes poverty levels a step further to include “what many consider to be basic necessities enjoyed by many Americans.” What MIT asks is: how much do individuals and families need to make to support themselves? The answer is the university’s living wage model.

“The living wage model is an alternative measure of basic needs. It is a market-based approach that draws upon geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities (e.g. clothing, personal care items, etc.) costs,” MIT states in describing “About” the model.

This is a perspective beyond the poverty threshold level to see how people can get ahead instead of treading water.

“The living wage draws on… cost elements and the rough effects of income and payroll taxes to determine the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency,” the description continues.

Minimum wage is the legislated point that U.S. society won’t let families slip under. When this fails to provide living wages, working adults must seek public assistance and/or hold multiple jobs to pay for food, shelter, clothing, grooming, health care, transportation, and additional multitudinous functional needs. The calculator accounts for the ability to endure beyond simple existence to planning and saving for potential hardships from unexpected medical and child care bills.

The beauty of establishing a livable income for families, MIT posits, is that fulfilling beyond very basic needs “would enable the working poor to achieve financial independence while maintaining housing and food security. When coupled with lowered expenses for childcare and housing, the living wage might also free up resources for savings, investment, and the purchase of capital assets (e.g., provisions for retirement or home purchases) that build wealth and ensure long-term financial stability and security.”

There’s a variety of critical financial plans to consider beyond today. For anyone who has lived check to check out there, it’s obvious the amount of stress that figures into uncertainty concerning food, shelter, clothing, and other vital needs.

As calculated in December 2021 and reflecting individual compensation in 2022, the living wage calculator found, that on average, the living wage in this country is $24.16 per hour, or $100,498.60 per year before taxes for a family of four with two working adults and two children. This compares to $21.54, and $89,605.51 in 2020, an almost 11% jump.

Zooming in, cost of living varies a good deal from place to place. Families in the North and West have higher average costs of living and therefore require higher living wages than families in the South and Midwest. MIT graphics show an incredible differential between how much people earn (and must earn) in different U.S. cities. In the McAllen-Edinburg-Mission tri-cities area in southern Texas, families average only about $81,000 annual income whereas in Silicon Valley, the average is almost $150,000, nearly double what low-wage workers on the Mexican border are making, on average.

Unfortunately for those on the low end, poverty hits the hard up most potently.

“A single mother with two children earning the federal minimum wage of $7.25 per hour needs to work 235 hours per week, the equivalent of almost six full-time minimum-wage jobs, to make a living wage,” MIT states.

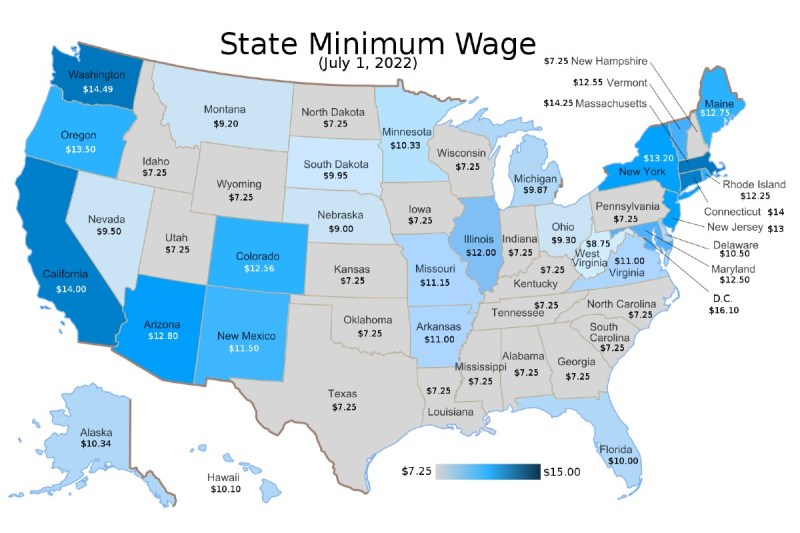

What’s not as well-known is that state minimum wages vary across the country as does how far the money actually goes. According to MIT, the minimum wage covers, at best, 59.8% of the living wage for two-adult, two-child families in Washington. At worst? Wisconsin, which accounts for a whopping 30% below the living wage, leaving thousands unable to cover basic needs.

What’s to be done? Well, it’s not difficult for federal and state governments and even localities to raise the minimum wage. Some places now even provide a living wage. Stockton, California, and the state of Alaska started the trend, but now places like Pittsburgh, Chicago, New Orleans, and New York all have some sort of basic universal income. The results of helping to lift people out of indentured servitude will be trickling out over the next few months and years.

Keep an eye on The Manual for developments to MIT’s Living Wage Calculator and other basic income initiatives. Glasmeier wrote in a 2022 update, for example, that the Cambridge university will be tracking inflation over the coming month in comparison to the change in the national CPI and make adjustments to the tool accordingly.