If you’ve been carefully reading through how to buy a house in recent times then you almost certainly know the importance of getting the right mortgage for you and finding the lowest rates for your situation. It can be a confusing world out there, especially when it comes to financial information, but that’s why Credit Karma is here to help. Besides offering regular, free updates on your credit score, Credit Karma in particular is a great tool to learn all about how much you can afford to pay for a house and what your monthly payment will be. It simplifies the process so you won’t be confused by anything. Read on while we take you through just how effective it is.

What is the Credit Karma Home Buying Power Calculator?

Credit Karma really couldn’t be simpler to use

Once you’ve entered those details, Credit Karma figures out the maximum home purchase price you can afford, along with the loan amount involved and what the monthly payments should be, as well as the lowest mortgage rates available to you. From there, you know exactly what to expect from your potential future home. Just keep in mind that you will need to be a Credit Karma user to use this too, but you can sign up for free now.

Why Should I Use Credit Karma?

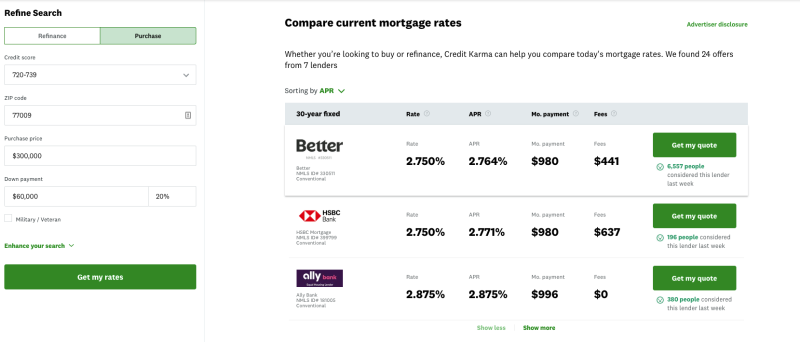

Credit Karma members get more benefits than simply receiving a free credit score whenever you head over to the website or open the app.As a member, you also get recommendations on the right mortgage offers for you. It’s all based on your credit score, ZIP code, and mortgage amount, so there’s no need to answer lengthy or invasive questionnaires to search for the offers that are most suitable for you. Worried your credit score isn’t up to scratch just yet? Credit Karma can also provide advice on how to improve it and figure out the best methods for you to consolidate any existing debt.

When it comes to homeowners eligible for refinancing deals, Credit Karma lists them all directly on your dashboard so you can select them at any time, instantly learning which lenders are best for you to work with. It’s like having your own helping hand each step of the way.

What Other Features Does Credit Karma Offer?

Credit Karma also has its Home Pulse equity tracker. The feature allows its members to link their home to their Credit Karma account. That way, you can then track the value and amount of equity you have on your home at any time with an optional feature enabling you to enter your current mortgage rate. From there, Credit Karma gives you a heads-up on any good refinancing opportunities based on an actual offer from one of its partners rather than pursuing a one-size-fits-all solution that other trackers might provide.

For instance, if you have a 4.0% rate on your house and Rocket is offering 3.25%, Credit Karma will proactively let you know, just as if it were your very own financial advisor. It’s far more effective than relying on algorithms or more general recommendations.

How Secure is Credit Karma?

When providing any company with lots of personal information, you want to know that such information is being kept safe. That’s certainly the case with anything you offer to Credit Karma. The company prides itself on never selling your information to additional partners or lenders. Instead, only the company that needs to receive your contact information will ever get it.

While many of Credit Karma’s competitors may sell your information to multiple lenders, meaning you get unsolicited calls and emails, Credit Karma never does this. That way, you only get the calls and emails that you want to receive.

How Do I Use Credit Karma?

Head over to the Credit Karma website and enter your details. It takes mere seconds to do and once you’ve got the relevant information, you’re good to go. It’s as simple as that. You won’t regret it and you’re likely to find a better deal than before.